UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

OR

For the transition period from ________ to ________

Commission file number:

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

||

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act). ☐ Yes

As of May 8, 2025, there were shares of common stock, $ par value per share, outstanding.

VERB TECHNOLOGY COMPANY, INC.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q for the three months ended March 31, 2025 (this “Quarterly Report”), includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which statements are subject to considerable risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not statements of historical facts and can be identified by words such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” or similar expressions and the negatives of those expressions. Forward-looking statements also include the assumptions underlying or relating to such statements.

Our forward-looking statements are based on our management’s current beliefs, assumptions and expectations about future events and trends, which affect or may affect our business, strategy, operations, financial performance or liquidity. Although we believe these forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of information currently available to us. Some of the risks and uncertainties that may impact our forward-looking statements include, but are not limited to, the following factors:

● our incursion of significant net losses and uncertainty whether we will achieve or maintain profitable operations;

● our ability to grow and compete in the future, and to execute our business strategy;

● our ability to maintain and expand our customer base and to convince our customers to increase the use of our services and/or platform;

● the competitive market in which we operate;

● our ability to increase the number of our strategic relationships or grow the revenues received from our current strategic relationships;

● our ability to develop enhancements and new features to our existing service or acceptable new services that keep pace with technological developments;

● our ability to successfully launch new product platforms, including MARKET.live, the rate of adoption of these platforms and the revenue generated from these platforms;

● our ability to deliver our services, as we depend on third party Internet providers;

● our ability to attract and retain qualified management personnel;

● our susceptibility to security breaches and other disruptions;

● our ability to maintain compliance with the listing requirements of the Nasdaq Capital Market; and

● the impact of, and our ability to operate our business and effectively manage our growth under evolving and uncertain global economic, political, and social trends, including legislation banning or otherwise hampering our strategic relationships such as TikTok, inflation, rising interest rates, and recessionary concerns.

The foregoing list may not include all of the risk factors that impact the forward-looking statements made in this Quarterly Report. Our actual financial condition and results could differ materially from those expressed or implied by our forward-looking statements as a result of various additional factors, including those discussed in the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in this Quarterly Report and in our Annual Report on Form 10-K for the year ended December 31, 2024 (our “Annual Report”), as well as in the other reports we file with the Securities and Exchange Commission (the “SEC”). You should read this Quarterly Report, and the other documents we file with the SEC, with the understanding that our actual future results may be materially different from the results expressed or implied by our forward-looking statements.

We operate in an evolving environment. New risks and uncertainties emerge from time to time and it is not possible for our management to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual future results to be materially different from those expressed or implied by any forward-looking statements.

Forward-looking statements speak only as of the date they were made, and, except to the extent required by law or the rules of the Nasdaq Capital Market, we undertake no obligation to update or review any forward-looking statement because of new information, future events or other factors.

We qualify all of our forward-looking statements by these cautionary statements.

| 3 |

PART I — FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

| 4 |

VERB TECHNOLOGY COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Revenue | $ | $ | ||||||

| Costs and expenses | ||||||||

| Cost of revenue, exclusive of depreciation and amortization shown separately below | ||||||||

| Depreciation and amortization | ||||||||

| General and administrative | ||||||||

| Total costs and expenses | ||||||||

| Operating loss from continuing operations | ( | ) | ( | ) | ||||

| Other income (expense), net | ||||||||

| Interest income | ||||||||

| Unrealized gain on short-term investments | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Other income (expense), net | ( | ) | ||||||

| Total other income (expense), net | ( | ) | ||||||

| Net loss | ( | ) | ( | ) | ||||

| Less: Net income attributable to non-controlling interests | ||||||||

| Net loss attributable to Verb Technology Company, Inc. | ( | ) | ( | ) | ||||

| Series C Preferred Stock dividend payable | ( | ) | ||||||

| Net loss to common stockholders | $ | ( | ) | $ | ( | ) | ||

| Loss per share from continuing operations– basic and diluted | $ | ) | $ | ) | ||||

| Weighted average number of common shares outstanding – basic and diluted | ||||||||

See accompanying notes to the condensed consolidated financial statements

| 5 |

VERB TECHNOLOGY COMPANY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| March 31, 2025 | December 31, 2024 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | $ | ||||||

| Restricted cash | ||||||||

| Accounts receivable, net of allowance for credit losses of $ | ||||||||

| ERC receivable – short-term | ||||||||

| Short-term investments - trading | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Capitalized software development costs, net | ||||||||

| Property and equipment, net | ||||||||

| Operating lease right-of-use assets | ||||||||

| Intangible assets, net | ||||||||

| Investment in equity securities | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Contract liabilities | ||||||||

| Accrued payroll | ||||||||

| Accrued officers’ compensation | ||||||||

| Note payable, current | ||||||||

| Operating lease liabilities, current | ||||||||

| Total current liabilities | ||||||||

| Long-term liabilities | ||||||||

| Note payable, non-current | ||||||||

| Operating lease liabilities, non-current | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies (Note 12) | ||||||||

| Stockholders’ equity | ||||||||

| Common stock, $ par value, shares authorized, and shares issued and outstanding as of March 31, 2025 and December 31, 2024 | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity in Verb Technology Company, Inc. | ||||||||

| Non-controlling interests | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

See accompanying notes to the condensed consolidated financial statements

| 6 |

VERB TECHNOLOGY COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share and per share data)

(unaudited)

For the three months ended March 31, 2025

Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Non-controlling | ||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | interests | Total | |||||||||||||||||||||||||

| Balance as of December 31, 2024 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||

| Fair value of vested restricted stock awards and stock options | - | |||||||||||||||||||||||||||||||

| Net income (loss) | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balance as of March 31, 2025 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||

For the three months ended March 31, 2024

| Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Non-controlling | ||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | interests | Total | |||||||||||||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

| Sale of common stock from public offering | - | |||||||||||||||||||||||||||||||

| Fair value of vested restricted stock awards and stock options | - | |||||||||||||||||||||||||||||||

| Fair value of common shares issued as payment on notes payable | - | |||||||||||||||||||||||||||||||

| Series C Preferred Stock dividends payable | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balance at March 31, 2024 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

See accompanying notes to the condensed consolidated financial statements

| 7 |

VERB TECHNOLOGY COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Operating Activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss used in operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Share-based compensation | ||||||||

| Unrealized gain on short-term investments – trading | ( | ) | ||||||

| Amortization of debt discount | ||||||||

| Amortization of debt issuance costs | ||||||||

| Change in fair value of derivative liability | ||||||||

| Effect of changes in assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| ERC receivable | ||||||||

| Prepaid expenses and other current assets | ( | ) | ||||||

| Operating lease right-of-use assets | ||||||||

| Accounts payable, accrued expenses, and accrued interest | ( | ) | ||||||

| Contract liabilities | ||||||||

| Operating lease liabilities | ( | ) | ( | ) | ||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Investing Activities: | ||||||||

| Purchases of investments – trading securities | ( | ) | ||||||

| Proceeds from sale of investments – trading securities | ||||||||

| Purchases of property and equipment | ( | ) | ( | ) | ||||

| Purchases of intangible assets | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Financing Activities: | ||||||||

| Proceeds from sale of common stock offerings | ||||||||

| Payments for accrued offering costs related to common stock offerings | ( | ) | ||||||

| Proceeds from (payments for) sale of preferred stock offerings | ( | ) | ||||||

| Payment of note payable | ( | ) | ( | ) | ||||

| Net cash provided by (used in) financing activities | ( | ) | ||||||

| Net change in cash and restricted cash | ( | ) | ||||||

| Cash and restricted cash - beginning of period | ||||||||

| Cash and restricted cash - end of period | $ | $ | ||||||

See accompanying notes to the condensed consolidated financial statements

| 8 |

VERB TECHNOLOGY COMPANY, INC.

Notes to Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2025 and 2024

(in thousands, except share and per share data)

(unaudited)

1. DESCRIPTION OF BUSINESS

Our Business

References in this document to the “Company,” “Verb,” “we,” “us,” or “our” are intended to mean Verb Technology Company, Inc., individually, or as the context requires, collectively with its subsidiaries on a consolidated basis.

Our business is currently comprised of three distinct, yet complimentary business units, all three of which are currently operating and generating revenue. The first business unit is MARKET.live focused on interactive video-based social commerce. Our MARKET.live platform is a multi-vendor, livestream social shopping destination leveraging the convergence of ecommerce and entertainment. Brands, retailers and creators that join MARKET.live have the ability to broadcast livestream shopping events simultaneously on numerous social media channels, including TikTok, YouTube, LinkedIn, Facebook, Instagram, Twitch, as well as on MARKET.live, reaching exponentially larger audiences.

The Company has developed and deployed technology integrations with META, TikTok, and Pinterest, among many others. For example, the Meta integration created a seamless, native, friction-free checkout process for Facebook and Instagram users to purchase MARKET.live vendors’ products within each of those popular apps. This integration allows Facebook and Instagram users to browse products featured in MARKET.live shoppable videos, place products in a native shopping cart and checkout – all without leaving Facebook or Instagram. Our TikTok technology integration allows shoppers watching a MARKET.live stream on TikTok to stay on TikTok and check out through TikTok, eliminating the friction or reluctance of TikTok users to leave their TikTok feed in order to complete their purchase. Our technology integration allows the purchase data to flow back through MARKET.live and to the individual vendors and stores on MARKET.live seamlessly for fulfillment of the orders.

Last year we announced an expanded strategic relationship with TikTok evidenced by a formal partnership with TikTok Shop pursuant to which MARKET.live became a service provider for TikTok Shop and officially designated as a TikTok Shop Partner (TSP). Under the terms of the partnership, TikTok Shop refers consumer brands, retailers, influencers and affiliates leads to MARKET.live for a menu of MARKET.live contract-based recurring fee revenue services that include, among other things, assistance in onboarding to TikTok Shop and establishing a TikTok store, hosting training sessions and webinars for prospective TikTok Shop sellers, full creative services including content creation and full remote and in-studio production services, host/influencer casting and management, TikTok Shop maintenance and enhancements for existing TikTok clients’ stores. The same services are currently provided to consumer brands that contact us directly or through several brand agencies with which we maintain affiliate relationships.

On April 17, 2025, we announced the closing of the acquisition of LyveCom, an artificial intelligence (“AI”) driven video commerce platform, pursuant to a stock purchase agreement dated April 11, 2025. The transaction terms are set forth in detail in the Form 8-K filed on April 17, 2025. See the Recent Developments section in this Form 10-Q. The integration of LyveCom’s technology into Verb’s MARKET.live is expected to allow brands and merchants to deliver a true omnichannel livestream shopping experience across their own websites, apps, and social platforms while leveraging MARKET.live’s new AI-powered video content automation and personalized shopping experiences. Today’s brands are beholden to big social media and their ever-changing algorithms, relying heavily on their platforms and closed marketplaces to maintain access to a borrowed audience. With this acquisition and technology integration, MARKET.live expects to be able to offer brands full control over their audience, content, and conversions while funneling ‘zero-party customer data’ back to the brand. Zero-party customer data refers to information a customer intentionally and proactively shares with a business. This very valuable data includes preferences, purchase intentions, personal contexts, and how the customer wants to be recognized. It’s distinct from first-party data, that is collected passively through website interactions, and third-party data, and typically purchased from external sources. The Lyvecom technology integration also provides brands and merchants with one-click capability to instantly simulcast and scale the broadcast of live shopping events across their own ecommerce sites and apps, marketplaces, and social platforms, maximizing audience reach and engagement while maintaining unified checkout and unified inventory management and control. A forthcoming release of the Market.live/Lyvecom integrated platform will include:

| ● | AI-Driven Video Commerce: Advanced AI capabilities will power real-time user-generated-content creation, automated video content repurposing, and AI-powered virtual live shopping hosts that are virtually indistinguishable from human hosts, capable of real-time audience engagement. | |

| ● | AI-Generated Video UGC: A proprietary AI model trained on tens of thousands of video commerce interactions that will automate content creation for brands. | |

| ● | AI-Powered Predictive Analytics and Automated Shoppable Content: Intelligent tools designed to optimize merchandising strategies and increase conversion rates. |

The second business unit is GO FUND YOURSELF!, an interactive social crowd funding platform for public and private companies seeking broad-based exposure across numerous social media channels for their crowd-funded Regulation CF and Regulation A offerings. The platform combines an interactive reality TV show that has been described as a combination of Shark Tank and Kickstarter with MARKET.live’s back-end capabilities allowing viewers to tap or scan onscreen icons and QR codes to facilitate an investment, in near real time, as they watch companies presenting before the Show’s panel of “Titans”. Presenting companies that sell consumer products are able to offer their products directly to viewers during the show in near real time through the same onscreen technology.

The Show airs weekly

on CheddarTV, available on most cable operators, prime time at 7pm EST. The Go Fund Yourself business unit generates revenue from cash

fees we charge to issuers to appear on the show and for marketing, ad, and content creation and distribution services. For those issuers

that sell products during each airing of the show through our platform, we charge a fee up to

| 9 |

The third business unit is Vanity Prescribed, a new telehealth initiative not unlike such companies as “HIMS” and “HERS” that are currently exploiting the rapid growth associated with the resale of the new weight-loss drugs. Vanity Prescribed leverages MARKET.live’s social commerce technology which the Company intends to employ to disrupt the traditional healthcare model by utilizing social commerce capabilities to provide tailored healthcare solutions at affordable, fixed prices, without hidden fees, membership costs, or inflated pharmaceutical markups.

On March 11, 2025, the Company announced the launch of GoodGirlRx.com, a partnership under Vanity Prescribed with Savannah Chrisley, a well-known lifestyle personality with millions of social media followers and an advocate for health and wellness. Through GoodGirlRx.com, customers will have access to convenient, no-hassle telehealth services and pharmaceuticals, including the new weight-loss drugs, that offer fixed pricing regardless of dosage, breaking away from the industry’s traditional model of excessive pricing and pharmaceutical gatekeeping. Through GoodGirlRx.com customers will be able to obtain virtual doctor visits with licensed physicians who can prescribe the weight loss drugs and other pharmaceuticals available to purchase on the site for those that qualify. Subscription pricing is also available through the site.

Historically, and continuing up through June 13, 2023, the Company was a Software-as-a-Service (“SaaS”) applications platform developer that offered a SaaS platform for the direct sales industry comprised of a suite of interactive video-based sales enablement business software products marketed on a subscription basis, (the “SaaS Assets”).

On April 12, 2019, the Company acquired Sound Concepts Inc. (“Sound Concepts”). The acquisition was intended to augment and diversify the Company’s internet and Software-as-a-Service (“SaaS”) business. Sound Concepts is now known as Verb Direct, LLC.

On September 4, 2020, Verb Acquisition Co., LLC (“Verb Acquisition”), a subsidiary of the Company, acquired Ascend Certification, LLC, dba SoloFire (“SoloFire”). The acquisition was intended to augment and diversify the Company’s internet and SaaS business.

On October 18, 2021, the Company established verbMarketplace, LLC (“Market LLC”), a Nevada limited liability company. Market LLC is a wholly owned subsidiary of the Company established for the MARKET.live platform.

On June 13, 2023,

the Company disposed of all of its operating SaaS assets of Verb Direct and Verb Acquisition, (referred to collectively as the “SaaS

Assets”) pursuant to an asset purchase agreement in consideration of the sum of $

On November 15, 2024, the Company formed Go Fund Yourself Show LLC (“Go Fund Yourself”), a Nevada limited liability company. Go Fund Yourself is a majority-owned subsidiary of the Company established for the Go Fund Yourself show.

On January 15, 2025, the Company formed Good Girl LLC, a Nevada limited liability company. Good Girl LLC is a majority-owned subsidiary of the Company.

As of March 31, 2025,

the Company had cash and restricted cash of $

| 10 |

Economic Disruption

Our business is dependent in part on general economic conditions. Many jurisdictions in which our customers are located and our products are sold have experienced and could continue to experience unfavorable general economic conditions, such as inflation, increased interest rates and recessionary concerns, which could negatively affect demand for our products. Under difficult economic conditions, customers may seek to cease spending on our current products or fail to adopt our new products, which could negatively affect our financial performance. We cannot predict the timing or magnitude of an economic slowdown or the timing or strength of any economic recovery. These and other economic factors could have a material adverse effect on our business, financial condition, and results of operations.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND SUPPLEMENTAL DISCLOSURES

Basis of Presentation

The accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 filed with the SEC on March 25, 2025 (the “2024 Annual Report”). The consolidated balance sheet as of December 31, 2024 included herein was derived from the audited consolidated financial statements as of that date.

On October 8, 2024,

we implemented a

As discussed in Note

1, among the terms of the Sale of the SaaS Assets was that additional payments of $

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as noted, all adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented herein are not necessarily indicative of fiscal year-end results.

Principles of Consolidation

The consolidated financial statements have been prepared in accordance with GAAP and include the accounts of Verb, Verb Direct, LLC, Verb Acquisition Co., LLC, verbMarketplace, LLC, Vanity Prescribed LLC, Good Girl LLC and Go Fund Yourself Show LLC. All intercompany accounts have been eliminated in the consolidation.

The

Company has consolidated the results of Go Fund Yourself Show, LLC and Good Girl LLC the Company has a

| 11 |

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reported periods. Management bases these estimates and assumptions upon historical experience, existing and known circumstances, and other factors that management believes to be reasonable. In addition, the Company has considered the potential impact of the pandemic, as well as certain macroeconomic factors, including inflation, rising interest rates, and recessionary concerns, on its business and operations.

Significant estimates include assumptions made in analysis of assumptions made in purchase price allocations, impairment testing of long-term assets, realization of deferred tax assets, determining fair value of its investments in debt and equity securities and valuation of equity instruments issued for services. Some of those assumptions can be subjective and complex, and therefore, actual results could differ materially from those estimates under different assumptions or conditions.

Segment Information

Effective July 1,

2024, the Company operates as

Revenue Recognition

The Company recognizes revenue in accordance with Financial Accounting Standard Board’s (“FASB”) ASC 606, Revenue from Contracts with Customers (“ASC 606”).

The underlying principle of ASC 606 is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected. ASC 606 creates a five-step model that requires entities to exercise judgment when considering the terms of contract(s), which includes

(1) identifying the contract(s) or agreement(s) with a customer,

(2) identifying our performance obligations in the contract or agreement,

(3) determining the transaction price,

(4) allocating the transaction price to the separate performance obligations, and

(5) recognizing revenue as each performance obligation is satisfied.

Pursuant to ASC 606, revenue is recognized when performance obligations (defined below) under the terms of a contract are satisfied, which occurs for the Company upon shipment or delivery of products or services to our customers based on written sales terms, which is also when control is transferred. Revenue is recognized in an amount that reflects the contractual consideration that the Company receives in exchange for its services.

A performance obligation is a promise in a contract to transfer a distinct product. Performance obligations promised in a contract are identified based on the goods that will be transferred that are both capable of being distinct and are distinct in the context of the contract, whereby the transfer of the goods is separately identifiable from other promises in the contract. Performance obligations for each segment are described below within each segment’s discussion of revenue recognition.

| 12 |

MARKET.live revenue is derived from contract-based recurring fee revenue services that include, among other things, a full suite of social commerce services for consumer brands and merchants seeking to adopt or expand online commerce and social selling capabilities, including end-to-end creative services such as content creation and full remote and in-studio production services, host/influencer/affiliate casting and management, TikTok Shop and other social media platform online store creation, set-up and establishment, maintenance and enhancements. Clients are referred to us through our existing partnership with TikTok Shop and other social media channels, as well as from several brand agencies with whom we maintain affiliate relationships. The revenue associated with these services is typically recognized over time as the performance obligations are completed.

Revenue is recognized on a net basis from maintaining e-commerce platforms and online orders, as for certain services the Company is engaged in an agency relationship with its customers and earns defined amounts based on the individual contractual terms for the customer and the Company does not take possession of the customers’ inventory or any credit risks relating to the products sold.

MARKET.live performance obligations for other services include special projects, content creation, and livestream management. Performance obligations also include establishing and maintaining customer online stores, providing access to the Company’s e-commerce platform and customer service support. These performance obligations are distinct and contribute to the overall service delivery and client management.

GO FUND YOURSELF Show

(“GFY”) derives revenue from fees we charge to issuers for full-scale onsite production services as the first

GO FUND YOURSELF Show performance obligations include the shoot date production services and post-production services that include editing services to create clips from the Show that the client issuers can distribute across social media and utilize in connection with their marketing initiatives. These performance obligations are distinct and contribute to the overall service delivery and client issuer engagement.

Vanity Prescribed/GoodGirlRx.com derives revenue from the sale of prescription and non-prescription pharmaceutical and health-care products, both through long-term subscriptions and non-prescription programs. The revenue associated with this revenue stream is recognized as of a point in time when the product is shipped to the customer.

The Company bears the entire performance obligation and risk. The primary performance obligation is the shipment of the prescribed medication to the customer. Ancillary services, such as prescription verification and customer support, are not distinct and are considered part of the medication delivery process. The cost of the consultation is only part of the performance obligation if the client does not already have a prescription. This is consistent with our position that our performance obligation is limited to shipping because we could not ship the product until the physician from the consultation issues the prescription.

| 13 |

Sales taxes collected from customers and remitted to governmental authorities are accounted for on a net basis and, therefore, are excluded from net sales in the consolidated statements of operations. Revenues during the three months ended March 31, 2025 and 2024, were substantially all generated from clients and customers located within the United States of America.

Cost of Revenue

Cost of revenue primarily consists of processing fees and independent contractors associated with the MARKET.live platform and independent contractors for shows related to Go Fund Yourself.

Contract Liabilities

Contract liabilities represent consideration received from customers under revenue contracts for which the Company has not yet delivered or completed its performance obligation to the customer. Contract liabilities are recognized over the contract period.

The following table provides information about contract liabilities from contracts with customers, including significant changes in the contract liabilities balance during the period:

| March 31, 2025 | December 31, 2024 | |||||||

| Beginning balance | $ | $ | ||||||

| Increase due to deferral of revenue | ||||||||

| Decrease due to recognition of revenue | ( | ) | ( | ) | ||||

| Ending balance | $ | $ | ||||||

The Company expects to recognize revenue related to contract liabilities within the next 12 months.

Accounts Receivable, net

Accounts receivable

is recorded at the invoiced amount and is stated at net realizable value. The Company estimates losses on receivables based on expected

losses, including its historical experience of actual losses. Receivables are considered impaired and written-off when it is probable

that all contractual payments due will not be collected in accordance with the terms of the agreement. As of March 31, 2025 and December

31, 2024, the accounts receivable balance was $

The Company follows

ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. On

a periodic basis, management evaluates its accounts receivable and determines whether to provide an allowance or if any accounts should

be written off based on past history of write-offs, collections, and current credit conditions. As of March 31, 2025 and December 31,

2024, the allowance for credit losses balance was $

During the three months

ended March 31, 2025, the Company received non-cash consideration in the form of non-marketable equity securities in exchange for services

rendered, which were originally recorded as accounts receivable. The fair value of the securities received was determined based on observable

inputs and relevant valuation techniques as of the date of receipt. The total non-cash consideration recognized in connection with these

transactions was $

| 14 |

Investments

In accordance with ASC 320, Investments – Debt Securities, the Company accounts for its investments as trading securities consisting of U.S. Treasury securities and corporate bonds that are reported at fair value on the Company’s unaudited consolidated balance sheet at March 31, 2025. Unrealized gains and losses on these investments are included in other income (expense), net within the Company’s unaudited condensed consolidated statements of operations.

The Company’s investments in trading securities are classified as current based on the intent of management, the nature of the investments and their availability for use in current operations.

The Company’s investments in equity securities primarily consist of non-marketable equity securities in private companies without readily determinable fair values. These investments are recorded at cost, less any impairment, plus or minus changes resulting from observable price changes in orderly transactions for the identical or similar investment of the same issuer, as permitted under ASC 321, Investments – Equity Securities.

The Company assesses its equity investments for impairment at each reporting period. If qualitative factors indicate that the investment is impaired, and the fair value is less than the carrying amount, an impairment loss is recognized in the Company’s consolidated financial statements. Observable price changes in orderly transactions for identical or similar securities of the same issuer are considered and may result in adjustments to the carrying amount of the investment. These changes, if any, are recorded in earnings in the period when identified.

Gains and losses resulting from remeasurements, impairments, or observable price changes are included in Other income (expense) in the accompanying consolidated statements of operations. The Company reevaluates the basis of its investments as of each balance sheet date and updates its carrying values as necessary.

See Note 3 – Investments and Fair Value Measurements for further details of the Company’s investments.

Capitalized Software Development Costs

The Company capitalizes internal and external costs directly associated with developing internal-use software, and hosting arrangements that include an internal-use software license, during the application development stage of its projects. The Company’s internal-use software is reported at cost less accumulated amortization. Amortization begins once the project has been completed and is ready for its intended use.

Due to changes in management’s assessment of its capitalized software development asset, the Company revised the asset’s remaining useful life effective January 1, 2024 and will amortize the asset on a straight-line basis over a period of four years. Software maintenance activities or minor upgrades are recorded as expense in the period performed.

Amortization expense related to capitalized software development costs are recorded in depreciation and amortization in the consolidated statements of operations.

Intangible Assets

We

have certain intangible assets that were initially recorded at their fair value at the time of acquisition. The finite-lived intangible

assets consist of developed technology and customer contracts. Indefinite-lived intangible assets consist of domain names. Intangible

assets with finite useful lives are amortized using the straight-line method over their estimated useful life of

We review all finite lived intangible assets for impairment when circumstances indicate that their carrying values may not be recoverable. If the carrying value of an asset group is not recoverable, we recognize an impairment loss for the excess carrying value over the fair value in our consolidated statements of operations.

Non-controlling Interests

Non-controlling

interests represents the portion of net assets in consolidated subsidiaries that are not attributable, directly or indirectly, to

the Company. In January 2025, we have entered into arrangements with third-party investors under which the investors are determined

to hold non-controlling interests in entities fully consolidated by the Company. The net assets of the shared entities are

attributed to the controlling and non-controlling interests based on the terms of the governing contractual arrangements. The net

income of $

Fair Value of Financial Instruments

The Company follows the guidance of FASB ASC 820 and ASC 825 for disclosure and measurement of the fair value of its financial instruments. FASB ASC 820 establishes a framework for measuring fair value under GAAP and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, ASC 820 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs.

The three (3) levels of fair value hierarchy defined by ASC 820 are described below:

| Level 1: | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| Level 2: | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| Level 3: | Pricing inputs that are generally observable inputs and not corroborated by market data. |

The carrying amount of the Company’s financial assets and liabilities, such as cash and cash equivalents, prepaid expenses, and accounts payable and accrued expenses approximate their fair value due to their short-term nature. The carrying amount of notes payable approximates the fair value due to the fact that the interest rates on these obligations are based on prevailing market interest rates.

| 15 |

Advertising Costs

All costs associated

with advertising, promotion and marketing programs are expensed as incurred. Advertising expense totaled $

The Company issues stock options and warrants, shares of common stock and restricted stock units as share-based compensation to employees and non-employees. The Company accounts for its share-based compensation in accordance with FASB ASC 718, Compensation – Stock Compensation. Share-based compensation cost is measured at the grant date, based on the estimated fair value of the award, and is recognized as expense over the requisite service period. The fair value of restricted stock units is determined based on the number of shares granted and the quoted price of our common stock and is recognized as expense over the service period. Forfeitures are accounted for as they occur. Recognition of compensation expense for non-employees is in the same period and manner as if the Company had paid cash for services.

Basic net loss per share is computed by using the weighted-average number of common shares outstanding during the period. Diluted net loss per share is computed giving effect to all dilutive potential shares of common stock that were outstanding during the period. Dilutive potential shares of common stock consist of incremental shares of common stock issuable upon exercise of stock options. No dilutive potential shares of common stock were included in the computation of diluted net loss per share because their impact was anti-dilutive.

As of March 31, 2025, and 2024, the Company had total outstanding options of and , respectively, and warrants of and , respectively, and outstanding restricted stock awards of and , respectively, which were excluded from the computation of net loss per share because they are anti-dilutive.

Concentration of Credit and Other Risks

Financial instruments

that potentially subject the Company to concentrations of credit risk consist of cash and accounts receivable. Cash is deposited with

a limited number of financial institutions. The balances held at any one financial institution at times may be in excess of Federal Deposit

Insurance Corporation (“FDIC”) insurance limits of up to $

| 16 |

The Company’s concentration of credit risk includes its concentrations from key customers and vendors. The details of these significant customers and vendors are presented in the following table for the three months ended March 31, 2025 and 2024:

| Three Months Ended March 31, | ||||

| 2025 | 2024 | |||

| The Company’s largest customers are presented below as a percentage of the aggregate | ||||

| Revenues and Accounts receivable | No customers individually over |

No customers individually over | ||

| The Company’s largest vendors are presented below as a percentage of the aggregate | ||||

| Purchases | No vendors accounted for

greater than |

One vendor that accounted for | ||

Supplemental Cash Flow Information

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for income taxes | $ | $ | ||||||

| Supplemental disclosure of non-cash investing and financing activities: | ||||||||

| Unpaid offering costs related to common stock offerings | $ | $ | ||||||

| Settlement of accounts receivable with non-marketable equity securities | ||||||||

| Fair value of common shares issued as payment on notes payable | ||||||||

Recent Accounting Pronouncements

New Accounting Pronouncements

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”). ASU 2023-09 requires additional income tax disclosures, including amendments to the rate reconciliation and income taxes paid disclosure. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024. Early adoption is permitted. The amendments should be applied on a prospective basis, but retrospective application is permitted. The Company does not anticipate that the adoption of this standard will have a material impact on the consolidated financial statements.

In November 2024, the FASB issued ASU No. 2024-03, Income Statement – Reporting Comprehensive Income (Subtopic 220-40): Expense Disaggregation Disclosures (“ASU 2024-03”). ASU 2024-03 requires additional information about specific expense categories in the notes to the financial statements. ASU 2024-03 is effective for fiscal years beginning after December 15, 2026. Early adoption is permitted. The amendments should be applied either (1) prospectively to financial statements issued after the effective date or (2) retrospectively to all prior periods presented in the financial statements. The Company is in the process of evaluating the effect this standard will have on the consolidated financial statement disclosures.

| 17 |

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS

The Company invests its surplus funds in excess of operational and capital requirements in a diversified portfolio of marketable securities, with the objectives of delivering competitive returns while maintaining a high degree of liquidity.

A summary of our short-term investments are as follows:

| March 31, 2025 | December 31, 2024 | |||||||

| U.S. treasury securities | $ | $ | ||||||

| Corporate bonds | ||||||||

| Short-term investments | $ | $ | ||||||

A summary of our long-term investments are as follows:

| March 31, 2025 | December 31, 2024 | |||||||

| Equity securities – at cost | $ | $ | ||||||

| Long-term investments | $ | $ | ||||||

Marketable securities

Marketable securities as of March 31, 2025 consisted of the following:

|

Cost of Amortized Cost |

Unrealized Gains |

Unrealized Losses |

Fair Value | |||||||||||||

| Marketable debt securities | ||||||||||||||||

| U.S. treasury securities | $ | $ | $ | $ | ||||||||||||

| Corporate bonds | ||||||||||||||||

| Total marketable debt securities | $ | $ | $ | $ | ||||||||||||

Fair Value Measurements

The Company’s financial instruments include cash, prepaid expenses, accounts payable, and accrued liabilities. The fair value of cash, prepaid expenses, accounts payable and accrued liabilities approximate their carrying values due to their short-term nature, which are all considered Level 1.

The Company’s financial instruments measured at fair value on a recurring basis consisted of U.S. treasury securities and corporate bonds. U.S. treasury securities are classified within Level 1 of the fair value hierarchy as they are valued based on quoted market price in an active market. Corporate bonds are valued based on quoted prices in markets that are less active and are generally classified within Level 2 of the fair value hierarchy.

The Company’s financial instruments valued based on unobservable inputs which reflect the reporting entity’s own assumptions or data that market participants would use in valuing an instrument are generally classified within Level 3 of the fair value hierarchy.

| 18 |

Financial instruments measured at fair value on a recurring basis as of March 31, 2025 are classified based on the valuation technique in the table below:

Fair Value Measurements Using

Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |||||||||||||

| Marketable debt securities | ||||||||||||||||

| U.S. treasury securities | $ | $ | $ | $ | ||||||||||||

| Corporate bonds | ||||||||||||||||

| Total marketable debt securities | $ | $ | $ | $ | ||||||||||||

4. CAPITALIZED SOFTWARE DEVELOPMENT COSTS

In 2020, the Company

began developing MARKET.live, a livestream ecommerce platform, and has capitalized $

For the three months

ended March 31, 2025 and 2024, the Company amortized $

Capitalized software development costs, net consisted of the following:

| March 31, 2025 | December 31, 2024 | |||||||

| Beginning balance | $ | $ | ||||||

| Additions | ||||||||

| Amortization | ( | ) | ( | ) | ||||

| Ending balance | $ | $ | ||||||

The expected future amortization expense for capitalized software development costs as of March 31, 2025, is as follows:

| Year ending | Amortization | |||

| 2025 remaining | $ | |||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| 2029 and thereafter | ||||

| Total amortization | $ | |||

| 19 |

5. OPERATING LEASES

The components of lease expense and supplemental cash flow information related to leases for the period are as follows:

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Lease cost | ||||||||

| Operating lease cost (included in general and administrative expenses in the Company’s statement of operations) | $ | $ | ||||||

| Other information | ||||||||

| Cash paid for amounts included in the measurement of lease liabilities | $ | $ | ||||||

| Weighted average remaining lease term – operating leases (in years) | ||||||||

| Weighted average discount rate – operating leases | % | % | ||||||

| March 31, 2025 | December 31, 2024 | |||||||

| Operating leases | ||||||||

| Right-of-use assets | $ | $ | ||||||

| Short-term operating lease liabilities | $ | $ | ||||||

| Long-term operating lease liabilities | ||||||||

| Total operating lease liabilities | $ | $ | ||||||

| Year ending | Operating Leases | |||

| 2025 remaining | $ | |||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| 2029 and thereafter | ||||

| Total lease payments | ||||

| Less: Imputed interest/present value discount | ( |

) | ||

| Present value of lease liabilities | $ | |||

6. NOTE PAYABLE

The Company has the following outstanding note payable as of March 31, 2025 and December 31, 2024:

| Note | Issuance Date | Maturity Date | Interest Rate | Original Borrowing | Balance at March 31, 2025 | Balance at December 31, 2024 | ||||||||||||||

| Note payable | % | $ | $ | $ | ||||||||||||||||

| Total note payable | ||||||||||||||||||||

| Non-current | ( | ) | ||||||||||||||||||

| Current | $ | $ | ||||||||||||||||||

On May 15, 2020, the Company executed an unsecured loan with the SBA under the Economic Injury Disaster Loan program in the amount of $

As of March 31, 2025 and December 31, 2024, the outstanding principal and accrued interest balance due under the note was $

| 20 |

The following table provides a breakdown of interest expense:

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Interest expense – amortization of debt discount | $ | $ | ||||||

| Interest expense – amortization of debt issuance costs | ||||||||

| Interest expense – other | ||||||||

| Total interest expense | $ | $ | ||||||

7. COMMON STOCK

The Company’s common stock activity for the three months ended March 31, 2025 is as follows:

Common Stock

Shares Issued for Services

During the three months ended March 31, 2025, the Company issued shares of common stock to Rory Cutaia, CEO, associated with the vesting of Restricted Stock Units.

During the three months ended March 31, 2025, the Company issued shares of common stock to its Lead Director, associated with the vesting of Restricted Stock Units.

See Note 13 – Subsequent Events.

8. RESTRICTED STOCK UNITS

| Weighted- | ||||||||

| Average | ||||||||

| Grant Date | ||||||||

| Shares | Fair Value | |||||||

| Non-vested at January 1, 2025 | $ | |||||||

| Granted | ||||||||

| Vested/deemed vested | ( | ) | ||||||

| Forfeited | ( | ) | ||||||

| Non-vested at March 31, 2025 | $ | |||||||

The total fair value of restricted stock units that vested or deemed vested during the three months ended March 31, 2025 was $. The total stock compensation expense recognized relating to the vesting of restricted stock units for the three months ended March 31, 2025 amounted to $. As of March 31, 2025, the amount of unvested compensation related to issuances of restricted stock units was $ which will be recognized as an expense in future periods as the shares vest.

On January 7, 2025,

the Company granted restricted stock units to officers and directors. The restricted stock units vest on January 7 of each year

from 2026 through 2029 for officers and vest on January 7, 2026 for non-employee directors. These restricted stock units were valued based

on the closing price of the Company’s common stock on the respective dates of issuance and had an aggregate grant date fair value

of $

| Weighted- | ||||||||||||||||

| Weighted- | Average | |||||||||||||||

| Average | Remaining | Aggregate | ||||||||||||||

| Exercise | Contractual | Intrinsic | ||||||||||||||

| Options | Price | Life (Years) | Value | |||||||||||||

| Outstanding at January 1, 2025 | $ | $ | ||||||||||||||

| Granted | - | - | ||||||||||||||

| Forfeited | ( | ) | - | - | ||||||||||||

| Exercised | - | - | ||||||||||||||

| Outstanding at March 31, 2025 | $ | $ | ||||||||||||||

| Vested March 31, 2025 | $ | $ | - | |||||||||||||

| Exercisable at March 31, 2025 | $ | $ | - | |||||||||||||

| 21 |

At March 31, 2025, the intrinsic value of the outstanding options was $.

The total stock compensation

expense recognized relating to the vesting of stock options for the three months ended March 31, 2025 amounted to $

On January 7, 2025, the Company granted shares of common stock to a Board Member with an exercise price of $, expiration of years, and a vesting period of year. The grant-date fair value was $ and will be amortized over the one-year vesting period.

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Risk-free interest rate | % | % | ||||||

| Average expected term | years | years | ||||||

| Expected volatility | % | % | ||||||

| Expected dividend yield | ||||||||

The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of measurement corresponding with the expected term of the share option award; the expected term represents the weighted-average period of time that share option awards granted are expected to be outstanding giving consideration to vesting schedules and historical participant exercise behavior; the expected volatility is based upon historical volatility of the Company’s common stock; and the expected dividend yield is based on the fact that the Company has not paid dividends in the past and does not expect to pay dividends in the future.

10. STOCK WARRANTS

The Company has the following warrants outstanding as of March 31, 2025, all of which are exercisable:

| Warrants | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Life (Years) | Aggregate Intrinsic Value | |||||||||||||

| Outstanding at January 1, 2025 | $ | $ | ||||||||||||||

| Granted | - | - | ||||||||||||||

| Forfeited | ( | ) | - | - | ||||||||||||

| Exercised | - | - | ||||||||||||||

| Outstanding at March 31, 2025, all vested | $ | $ | ||||||||||||||

At March 31, 2025, the intrinsic value of the outstanding warrants was $.

| 22 |

11. COMMITMENTS AND CONTINGENCIES

Litigation

The Company is currently

in a dispute with a former employee of its predecessor bBooth, Inc. who has interposed a breach of contract claim in which he alleges

that in 2015 he was entitled to approximately $

The Company knows of no material proceedings in which any of its directors, officers, or affiliates, or any registered or beneficial stockholder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

The Company believes it has adequately reserved for all litigation within its financial statements.

Board of Directors

The Company has committed

an aggregate of $

Total board fees expensed

during the three months ended March 31, 2025 was $

12. SEGMENT REPORTING

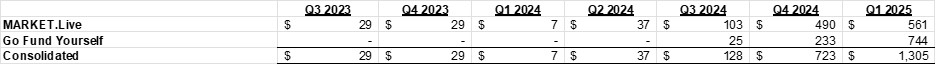

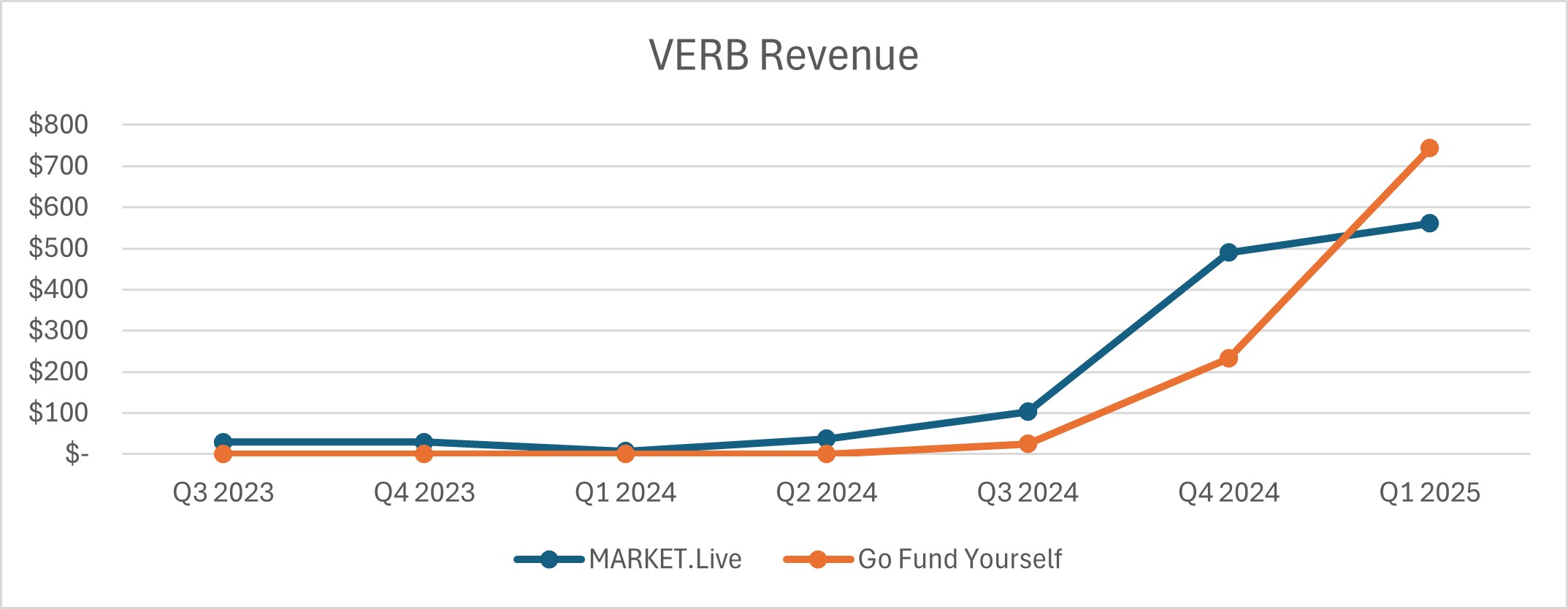

The Company currently operates two reportable segments, MARKET.live and Go Fund Yourself. The Company also operates a third business unit, currently operating in stealth mode, which for the three months ending March 31, 2025, the Company does not deem to be a reportable segment.

The following tables summarize the Company’s reportable segment information and unallocated corporate expenses:

| 3 months ended March 31, 2025 | 3 months ended March 31, 2024 | |||||||||||||||||||||||||||||||

| Reportable Segments | Reportable Segments | |||||||||||||||||||||||||||||||

| MARKET.live | Go Fund Yourself | Corporate | Consolidated | MARKET.live | Go Fund Yourself | Corporate | Consolidated | |||||||||||||||||||||||||

| Revenues | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||||||||

| Cost of revenue, exclusive of depreciation and amortization shown separately below | ||||||||||||||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||||||||||

| General and administrative | ||||||||||||||||||||||||||||||||

| Total costs and expenses | ||||||||||||||||||||||||||||||||

| Operating income (loss) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||||||||

| 23 |

Total assets by reportable segment as of March 31, 2025 is as follows:

| Corporate | Go Fund Yourself | MARKET.Live | Consolidated | |||||||||||||

| ASSETS | ||||||||||||||||

| Current assets: | ||||||||||||||||

| Cash | $ | $ | $ | $ | ||||||||||||

| Restricted cash | ||||||||||||||||

| Accounts receivable | ||||||||||||||||

| ERC Receivable - short-term | ||||||||||||||||

| Short-term investments - trading | ||||||||||||||||

| Prepaid expenses and other current assets | ||||||||||||||||

| Total current assets | ||||||||||||||||

| Capitalized software development costs | ||||||||||||||||

| Property and equipment, net | ||||||||||||||||

| Operating lease right-of-use assets | ||||||||||||||||

| Intangible assets, net | ||||||||||||||||

| Investment in equity securities | ||||||||||||||||

| Other non-current assets | ||||||||||||||||

| Total assets | $ | $ | $ | $ | ||||||||||||

13. SUBSEQUENT EVENTS

Issuances of Common Stock

Subsequent to March 31, 2025, the Company issued shares of common stock to Mr. Cutaia associated with the vesting of restricted stock units.

Subsequent to March 31, 2025, the Company issued shares of common stock to its Lead Director associated with the vesting of restricted stock units.

Acquisition of Lyvecom

On

February 28, 2025, the Company entered into a Binding Term Sheet (the “Binding Term Sheet”) with Lyvecom, Inc.

(“Lyvecom”) and the shareholders of Lyvecom (the “Lyvecom Shareholders”) to acquire all the outstanding

capital stock of Lyvecom (the “Acquisition”). On April 11, 2025, the Company, Lyvecom and the Lyvecom Shareholders

entered into a definitive Stock Purchase Agreement with respect to the Acquisition that incorporated the terms of the Binding Term

Sheet (the “Purchase Agreement”). The Acquisition closed on April 11, 2025. The purchase price paid for the shares of

capital stock of Lyvecom was $

Equity Financing

On April 23, 2025,

the Company filed a certificate of designation of preferences and rights of Series D Non-Convertible

Preferred Stock (the “Series D Preferred Stock”), with the Secretary of State of Nevada, designating shares of non-convertible

preferred stock, par value $ of the Company, as Series D Preferred Stock. Each share of Series D Preferred Stock shall have a stated

face value of $

On April 22, 2025,

the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Streeterville Capital,

LLC (the “Investor”). Pursuant to the Securities Purchase Agreement, the Company and Investor agreed that the Company shall

sell and the Investor agreed to purchase shares of the Company’s newly designated Non-Convertible, Non-Voting Series D Preferred

Stock (the “Shares”) for a total purchase price of $

| 24 |

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

The following discussion and analysis of the results of operations and financial condition of our company for the three-month periods ended March 31, 2025 and 2024 should be read in conjunction with the financial statements and related notes and the other financial information that are included elsewhere this Quarterly Report on Form 10-Q. This discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations, and intentions. Forward-looking statements are statements not based on historical fact and which relate to future operations, strategies, financial results, or other developments. Forward-looking statements are based upon estimates, forecasts, and assumptions that are inherently subject to significant business, economic, and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to business decisions, are subject to change. These uncertainties and contingencies can cause actual results to differ materially from those expressed in any forward-looking statements made by us, or on our behalf. We disclaim any obligation to update forward-looking statements. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

As used in this Quarterly Report on Form 10-Q, the terms “we,” “us,” “our,” and “Verb” refer to Verb Technology Company, Inc., a Nevada corporation, individually, or as the context requires, collectively with its subsidiaries, Verb Direct, LLC, Verb Acquisition Co., Inc., Vanity Prescribed LLC, Good Girl LLC, and verbMarketplace, LLC, dba MARKET.live, on a consolidated basis, unless otherwise specified.

Overview

Our MARKET.live Business

Our business is currently comprised of three distinct, yet complimentary business units, all three of which are currently operating and generating revenue. The first business unit is MARKET.live focused on interactive video-based social commerce. Our MARKET.live platform is a multi-vendor, livestream social shopping destination leveraging the convergence of ecommerce and entertainment. Brands, retailers and creators that join MARKET.live have the ability to broadcast livestream shopping events simultaneously on numerous social media channels, including TikTok, YouTube, LinkedIn, Facebook, Instagram, Twitch, as well as on MARKET.live, reaching exponentially larger audiences.

The Company has developed and deployed technology integrations with META, TikTok, and Pinterest, among many others. For example, the Meta integration created a seamless, native, friction-free checkout process for Facebook and Instagram users to purchase MARKET.live vendors’ products within each of those popular apps. This integration allows Facebook and Instagram users to browse products featured in MARKET.live shoppable videos, place products in a native shopping cart and checkout – all without leaving Facebook or Instagram. Our TikTok technology integration allows shoppers watching a MARKET.live stream on TikTok to stay on TikTok and check out through TikTok, eliminating the friction or reluctance of TikTok users to leave their TikTok feed in order to complete their purchase. Our technology integration allows the purchase data to flow back through MARKET.live and to the individual vendors and stores on MARKET.live seamlessly for fulfillment of the orders.

Last year we announced an expanded strategic relationship with TikTok evidenced by a formal partnership with TikTok Shop pursuant to which MARKET.live became a service provider for TikTok Shop and officially designated as a TikTok Shop Partner (TSP). Under the terms of the partnership, TikTok Shop refers consumer brands, retailers, influencers and affiliates leads to MARKET.live for a menu of MARKET.live contract-based recurring fee revenue services that include, among other things, assistance in onboarding to TikTok Shop and establishing a TikTok store, hosting training sessions and webinars for prospective TikTok Shop sellers, full creative services including content creation and full remote and in-studio production services, host/influencer casting and management, TikTok Shop maintenance and enhancements for existing TikTok clients’ stores. The same services are currently provided to consumer brands that contact us directly or through several brand agencies with which we maintain affiliate relationships.

| 25 |

On March 4, 2025, we announced the execution of a binding term sheet to acquire LyveCom, an artificial intelligence (“AI”) driven video commerce platform. On April 17, 2025, we announced the closing of the transaction. See the Recent Developments section in this Form 10-Q. Phase 1 of the integration of LyveCom’s technology is complete and the new, updated version of the MARKET.live was officially launched on March 4, 2025. This technology integration now allows our brand and merchant customers and clients to deliver an omnichannel livestream shopping experience to their own customers. Brands and merchants will not only engage their clients and customers on the newly updated and refreshed MARKET.live site, but also seamlessly across their own websites, mobile apps, and social platforms, all while leveraging MARKET.live’s new AI-powered video content automation and personalized shopping experiences.

This proprietary technology embeds livestreams and shoppable videos directly onto merchant websites without impact on site speed, while simultaneously aggregating and repurposing content from TikTok, Instagram, and YouTube into interactive shopping experiences, allowing brands to engage customers without constant content production. Other new features and functionality now available through MARKET.live include:

| ● | One-Click Simulcasting: Instantly scale the broadcast of live shopping events across MARKET.live, TikTok Shop, Shopify’s Shop App, and other social sites, including the brand or merchant’s own e-commerce sites, maximizing audience reach and engagement, while maintaining checkout and unified inventory management and control across all of the brand’s or merchant’s social sites and platforms. | |

| ● | AI-Driven Video Commerce: Advanced AI capabilities will power real-time user-generated-content creation, automated video content repurposing, and AI-powered virtual live shopping hosts. | |

| ● | Frictionless Merchant Integration: Frictionless, self-serve onboarding for merchants, enabling millions of Shopify merchants to adopt live and shoppable video with a simple 3-click integration, making livestream shopping capabilities more accessible and useable than ever. | |

| ● | New Strategic Partnerships: New and expanded strategic partnerships with Tapcart, Shopify Shop App, Klaviyo, Recharge, and agency networks will expand MARKET.live’s footprint into mobile commerce and high-growth DTC brands. | |

| ● | Real-Time Data & Analytics: An intelligent analytics hub will provide in-depth insights into shopper behavior, enabling merchants to refine strategies and boost conversions. |

| 26 |

The second business unit is GO FUND YOURSELF!, an interactive social crowd funding platform for public and private companies seeking broad-based exposure across numerous social media channels for their crowd-funded Regulation CF and Regulation A offerings. The platform combines an interactive reality TV show that has been described as a combination of Shark Tank and Kickstarter with MARKET.live’s back-end capabilities allowing viewers to tap or scan onscreen icons and QR codes to facilitate an investment, in near real time, as they watch companies presenting before the Show’s panel of “Titans”. Presenting companies that sell consumer products are able to offer their products directly to viewers during the show in near real time through the same onscreen technology.

The Show airs weekly on CheddarTV, available on most cable operators, prime time at 7pm EST. The Go Fund Yourself business unit generates revenue from cash fees we charge to issuers to appear on the show and for marketing, ad, and content creation and distribution services. For those issuers that sell products during each airing of the show through our platform, we charge a fee up to 25% of the gross sales revenue for all products sold. The Show’s expert panel of “Titans” include rotating celebrity guest Titans from the worlds of business, sports, and entertainment, such as NFL Hall of Fame running back Marshall Faulk, among many others, as well as the recurring panel of Titans that include David Meltzer – Chairman of the Napoleon Hill Institute and Former CEO of the Leigh Steinberg Sports & Entertainment agency; Jayson Waller – thought leader, CEO of multiple multi-million-dollar companies, and host of the popular ‘Jayson Waller Unleashed’ Podcast; and Rory J. Cutaia – the Show’s creator and the Founder, Chairman and CEO of Verb, each of whom are executive producers and minority owners of the Show.

The third business unit is Vanity Prescribed, a new telehealth initiative not unlike such companies as “HIMS” and “HERS” that are currently exploiting the rapid growth associated with the resale of the new weight-loss drugs. Vanity Prescribed leverages MARKET.live’s social commerce technology which the Company intends to employ to disrupt the traditional healthcare model by utilizing social commerce capabilities to provide tailored healthcare solutions at affordable, fixed prices, without hidden fees, membership costs, or inflated pharmaceutical markups.

On March 11, 2025, the Company announced the launch of GoodGirlRx.com, a partnership under Vanity Prescribed with Savannah Chrisley, a well-known lifestyle personality with millions of social media followers and an advocate for health and wellness. Through GoodGirlRx.com, customers will have access to convenient, no-hassle telehealth services and pharmaceuticals, including the new weight-loss drugs, that offer fixed pricing regardless of dosage, breaking away from the industry’s traditional model of excessive pricing and pharmaceutical gatekeeping. Through GoodGirlRx.com customers will be able to obtain virtual doctor visits with licensed physicians who can prescribe the weight loss drugs and other pharmaceuticals available to purchase on the site for those that qualify. Subscription pricing is also available through the site.

Revenue Generation

MARKET.live revenue is derived from contract-based recurring fee revenue services that include, among other things, a full suite of social commerce services for consumer brands and merchants seeking to adopt or expand online commerce and social selling capabilities, including end-to-end creative services such as content creation and full remote and in-studio production services, host/influencer/affiliate casting and management, TikTok Shop and other social media platform online store creation, set-up and establishment, maintenance and enhancements. Clients are referred to us through our existing partnership with TikTok Shop and other social media channels, as well as from several brand agencies with whom we maintain affiliate relationships.

GO FUND YOURSELF Show derives revenue from fees we charge to issuers to appear on the show and for marketing, ad, and content creation and distribution services. Appearance fees are based on service packages that range from $15,000 to $60,000 per issuer. For those issuers that sell products during each airing of the show through our platform, we charge a fee of up to 25% of the gross sales revenue for all products sold.

| 27 |

Vanity Prescribed/GoodGirlRx.com derives revenue from the sale of prescription and non-prescription pharmaceutical and health-care products, both through long-term subscriptions and non-prescription programs.

Historically, and continuing up through June 13, 2023, we were a Software-as-a-Service (“SaaS”) applications platform developer that offered a SaaS platform for the direct sales industry comprised of a suite of interactive video-based sales enablement business software products marketed on a subscription basis, (the “SaaS Assets”).

On June 13, 2023, the Company disposed of all of its operating SaaS Assets pursuant to an asset purchase agreement in consideration of the sum of $6,500, $4,750 of which was paid in cash by the buyer at the closing of the transaction (the “Sale of the SaaS Assets”). An additional payment in the aggregate of $0.75 million will be paid by the buyer if certain profitability and revenue targets are met during the second year following the closing date as set forth more particularly in the asset purchase agreement. A similar payment would have been due and payable to the Company after the first year following the closing if the buyer had met certain profitability and revenue targets specified in the asset purchase agreement, which it failed to meet. The sale of the SaaS Assets was undertaken to allow the Company to focus its resources on its burgeoning MARKET.live business unit which it expects over time will create greater shareholder value.

Revenue is recognized in an amount that reflects the contractual consideration that the Company receives in exchange for its services. The Company does not take possession of the customers’ inventory or any credit risks relating to the products sold.

Sales taxes collected from customers and remitted to governmental authorities are accounted for on a net basis and, therefore, are excluded from net sales in the consolidated statements of operations. Revenues during the three months ended March 31, 2025 and 2024, were substantially all generated from clients and customers located within the United States of America.

Economic Disruption